Page 15 - Demo

P. 15

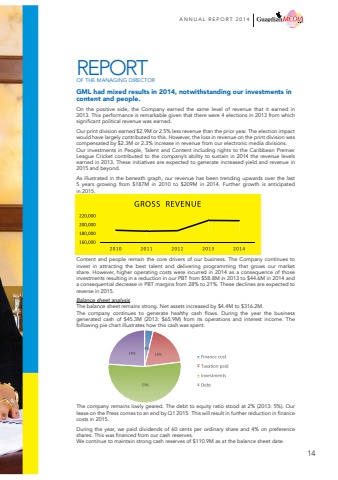

ANNUAL REPORT 201414GML had mixed results in 2014, notwithstanding our investments in content and people.On the positive side, the Company earned the same level of revenue that it earned in 2013. This performance is remarkable given that there were 4 elections in 2013 from which significant political revenue was earned. Our print division earned $2.9M or 2.5% less revenue than the prior year. The election impact would have largely contributed to this. However, the loss in revenue on the print division was compensated by $2.3M or 2.3% increase in revenue from our electronic media divisions. Our investments in People, Talent and Content including rights to the Caribbean Premier League Cricket contributed to the company%u2019s ability to sustain in 2014 the revenue levels earned in 2013. These initiatives are expected to generate increased yield and revenue in 2015 and beyond.As illustrated in the beneath graph, our revenue has been trending upwards over the last5 years growing from $187M in 2010 to $209M in 2014. Further growth is anticipatedin 2015.Content and people remain the core drivers of our business. The Company continues to invest in attracting the best talent and delivering programming that grows our market share. However, higher operating costs were incurred in 2014 as a consequence of those investments resulting in a reduction in our PBT from $58.8M in 2013 to $44.6M in 2014 and a consequential decrease in PBT margins from 28% to 21%. These declines are expected to reverse in 2015.Balance sheet analysisThe balance sheet remains strong. Net assets increased by $4.4M to $316.2M.The company continues to generate healthy cash flows. During the year the business generated cash of $45.3M (2013: $65.9M) from its operations and interest income. The following pie chart illustrates how this cash was spent:The company remains lowly geared. The debt to equity ratio stood at 2% (2013: 5%). Our lease on the Press comes to an end by Q1 2015. This will result in further reduction in finance costs in 2015. During the year, we paid dividends of 60 cents per ordinary share and 4% on preference shares. This was financed from our cash reserves. We continue to maintain strong cash reserves of $110.9M as at the balance sheet date. REPORTOF THE MANAGING DIRECTOR