Page 88 - Demo

P. 88

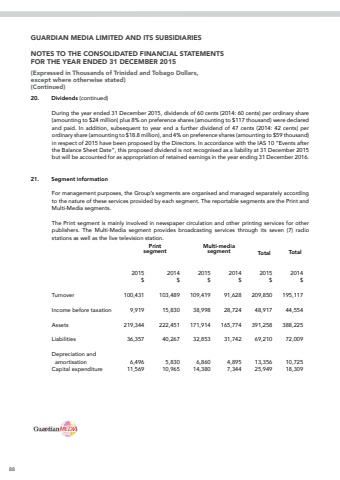

88GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 201520. Dividends (continued)During the year ended 31 December 2015, dividends of 60 cents (2014: 60 cents) per ordinary share (amounting to $24 million) plus 8% on preference shares (amounting to $117 thousand) were declared and paid. In addition, subsequent to year end a further dividend of 47 cents (2014: 42 cents) per ordinary share (amounting to $18.8 million), and 4% on preference shares (amounting to $59 thousand) in respect of 2015 have been proposed by the Directors. In accordance with the IAS 10 %u201cEvents after the Balance Sheet Date%u201d, this proposed dividend is not recognised as a liability at 31 December 2015 but will be accounted for as appropriation of retained earnings in the year ending 31 December 2016.21. Segment informationFor management purposes, the Group%u2019s segments are organised and managed separately according to the nature of these services provided by each segment. The reportable segments are the Print and Multi-Media segments.The Print segment is mainly involved in newspaper circulation and other printing services for other publishers. The Multi-Media segment provides broadcasting services through its seven (7) radio stations as well as the live television station.2015 2014 2015 2014 2015 2014$ $ $ $ $ $Turnover 100,431 103,489 109,419 91,628 209,850 195,117Income before taxation 9,919 15,830 38,998 28,724 48,917 44,554Assets 219,344 222,451 171,914 165,774 391,258 388,225Liabilities 36,357 40,267 32,853 31,742 69,210 72,009Depreciation and amortisation 6,496 5,830 6,860 4,895 13,356 10,725Capital expenditure 11,569 10,965 14,380 7,344 25,949 18,309PrintsegmentMulti-mediasegment Total Total(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)