Page 107 - Demo

P. 107

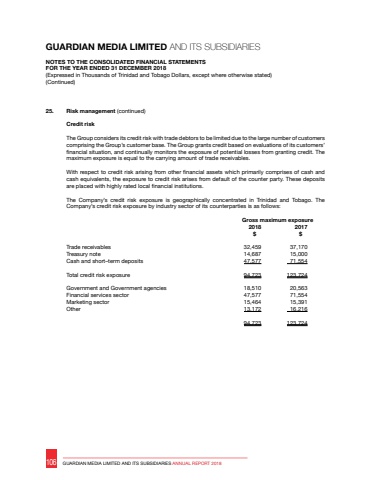

GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2018(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)25. Risk management (continued)Credit riskThe Group considers its credit risk with trade debtors to be limited due to the large number of customers comprising the Group%u2019s customer base. The Group grants credit based on evaluations of its customers%u2019 fnancial situation, and continually monitors the exposure of potential losses from granting credit. The maximum exposure is equal to the carrying amount of trade receivables.With respect to credit risk arising from other fnancial assets which primarily comprises of cash and cash equivalents, the exposure to credit risk arises from default of the counter party. These deposits are placed with highly rated local fnancial institutions.The Company%u2019s credit risk exposure is geographically concentrated in Trinidad and Tobago. The Company%u2019s credit risk exposure by industry sector of its counterparties is as follows: Gross maximum exposure2018 2017$ $Trade receivables 32,459 37,170Treasury note 14,687 15,000Cash and short%u2013term deposits 47,577 71,554Total credit risk exposure 94,723 123,724Government and Government agencies 18,510 20,563Financial services sector 47,577 71,554Marketing sector 15,464 15,391Other 13,172 16,21694,723 123,724106 GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIES ANNUAL REPORT 2018