Page 87 - Demo

P. 87

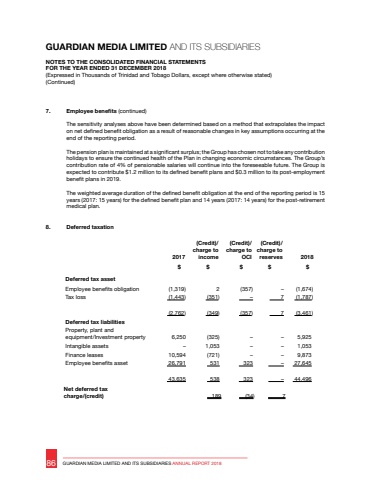

GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2018(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)7. Employee benefts (continued)The sensitivity analyses above have been determined based on a method that extrapolates the impact on net defned beneft obligation as a result of reasonable changes in key assumptions occurring at the end of the reporting period.The pension plan is maintained at a signifcant surplus; the Group has chosen not to take any contribution holidays to ensure the continued health of the Plan in changing economic circumstances. The Group%u2019s contribution rate of 4% of pensionable salaries will continue into the foreseeable future. The Group is expected to contribute $1.2 million to its defned beneft plans and $0.3 million to its post-employment beneft plans in 2019.The weighted average duration of the defned beneft obligation at the end of the reporting period is 15 years (2017: 15 years) for the defned beneft plan and 14 years (2017: 14 years) for the post-retirement medical plan.8. Deferred taxation2017(Credit)/ charge to income(Credit)/ charge to OCI(Credit)/charge to reserves 2018 $ $ $ $ $Deferred tax assetEmployee benefts obligation (1,319) 2 (357) %u2013 (1,674)Tax loss (1,443) (351) %u2013 7 (1,787) (2,762) (349) (357) 7 (3,461)Deferred tax liabilitiesProperty, plant and equipment/Investment property 6,250 (325) %u2013 %u2013 5,925Intangible assets %u2013 1,053 %u2013 %u2013 1,053 Finance leases 10,594 (721) %u2013 %u2013 9,873Employee benefts asset 26,791 531 323 %u2013 27,645 43,635 538 323 %u2013 44,496Net deferred tax charge/(credit) 189 (34) 786 GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIES ANNUAL REPORT 2018