Page 54 - Demo

P. 54

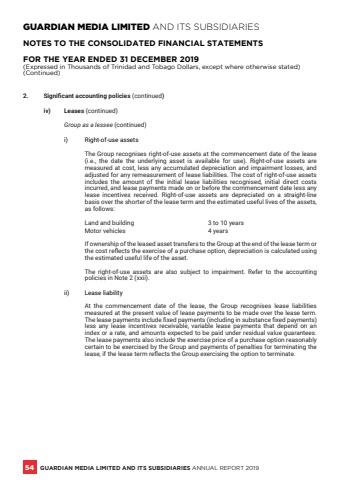

GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2019(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)2.%u0009 Significant accounting policies (continued)iv) Leases (continued)Group as a lessee (continued)i) Right-of-use assetsThe Group recognises right-of-use assets at the commencement date of the lease (i.e., the date the underlying asset is available for use). Right-of-use assets are measured at cost, less any accumulated depreciation and impairment losses, and adjusted for any remeasurement of lease liabilities. The cost of right-of-use assets includes the amount of the initial lease liabilities recognised, initial direct costs incurred, and lease payments made on or before the commencement date less any lease incentives received. Right-of-use assets are depreciated on a straight-line basis over the shorter of the lease term and the estimated useful lives of the assets, as follows:Land and building 3 to 10 yearsMotor vehicles 4 yearsIf ownership of the leased asset transfers to the Group at the end of the lease term or the cost reflects the exercise of a purchase option, depreciation is calculated using the estimated useful life of the asset.The right-of-use assets are also subject to impairment. Refer to the accounting policies in Note 2 (xxii).ii) Lease liabilityAt the commencement date of the lease, the Group recognises lease liabilities measured at the present value of lease payments to be made over the lease term. The lease payments include fixed payments (including in substance fixed payments) less any lease incentives receivable, variable lease payments that depend on an index or a rate, and amounts expected to be paid under residual value guarantees. The lease payments also include the exercise price of a purchase option reasonably certain to be exercised by the Group and payments of penalties for terminating the lease, if the lease term reflects the Group exercising the option to terminate.54 GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIES ANNUAL REPORT 2019