Page 114 - Demo

P. 114

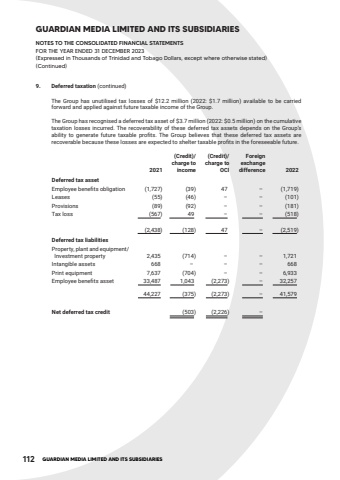

112 GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIES GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2023(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)9. Deferred taxation (continued)The Group has unutilised tax losses of $12.2 million (2022: $1.7 million) available to be carried forward and applied against future taxable income of the Group.The Group has recognised a deferred tax asset of $3.7 million (2022: $0.5 million) on the cumulative taxation losses incurred. The recoverability of these deferred tax assets depends on the Group%u2019s ability to generate future taxable profits. The Group believes that these deferred tax assets are recoverable because these losses are expected to shelter taxable profits in the foreseeable future.2021(Credit)/ charge to income(Credit)/ charge to OCIForeign exchange difference 2022Deferred tax assetEmployee benefits obligation (1,727) (39) 47 %u2013 (1,719)Leases (55) (46) %u2013 %u2013 (101)Provisions (89) (92) %u2013 %u2013 (181)Tax loss (567) 49 %u2013 %u2013 (518) (2,438) (128) 47 %u2013 (2,519)Deferred tax liabilitiesProperty, plant and equipment/Investment property 2,435 (714) %u2013 %u2013 1,721Intangible assets 668 %u2013 %u2013 %u2013 668Print equipment 7,637 (704) %u2013 %u2013 6,933Employee benefits asset 33,487 1,043 (2,273) %u2013 32,257 44,227 (375) (2,273) %u2013 41,579Net deferred tax credit (503) (2,226) %u2013