Page 128 - Demo

P. 128

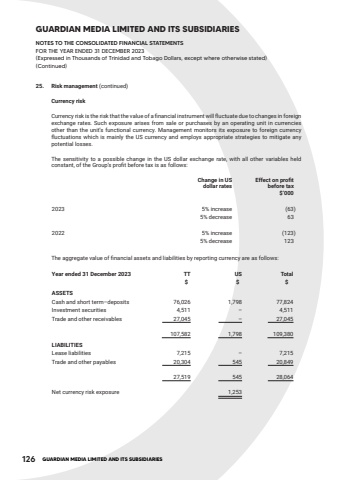

126 GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIES GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2023(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)25. Risk management (continued)Currency riskCurrency risk is the risk that the value of a financial instrument will fluctuate due to changes in foreign exchange rates. Such exposure arises from sale or purchases by an operating unit in currencies other than the unit%u2019s functional currency. Management monitors its exposure to foreign currency fluctuations which is mainly the US currency and employs appropriate strategies to mitigate any potential losses.The sensitivity to a possible change in the US dollar exchange rate, with all other variables held constant, of the Group%u2019s profit before tax is as follows:Change in US dollar ratesEffect on profit before tax $%u20190002023 5% increase (63)5% decrease 632022 5% increase (123)5% decrease 123The aggregate value of financial assets and liabilities by reporting currency are as follows:Year ended 31 December 2023 TT US Total$ $ $ASSETSCash and short term%u2013deposits 76,026 1,798 77,824Investment securities 4,511 %u2013 4,511Trade and other receivables 27,045 %u2013 27,045 107,582 1,798 109,380LIABILITIESLease liabilities 7,215 %u2013 7,215Trade and other payables 20,304 545 20,849 27,519 545 28,064Net currency risk exposure 1,253