Page 129 - Demo

P. 129

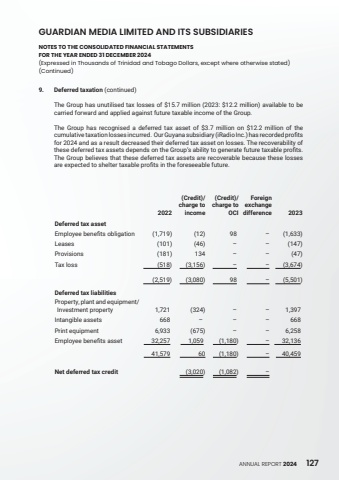

ANNUAL REPORT 2024 127GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2024(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)9. Deferred taxation (continued)The Group has unutilised tax losses of $15.7 million (2023: $12.2 million) available to be carried forward and applied against future taxable income of the Group.The Group has recognised a deferred tax asset of $3.7 million on $12.2 million of the cumulative taxation losses incurred. Our Guyana subsidiary (iRadio Inc.) has recorded profits for 2024 and as a result decreased their deferred tax asset on losses. The recoverability of these deferred tax assets depends on the Group%u2019s ability to generate future taxable profits. The Group believes that these deferred tax assets are recoverable because these losses are expected to shelter taxable profits in the foreseeable future.2022(Credit)/ charge to income(Credit)/ charge to OCIForeign exchange difference 2023Deferred tax assetEmployee benefits obligation (1,719) (12) 98 %u2013 (1,633)Leases (101) (46) %u2013 %u2013 (147)Provisions (181) 134 %u2013 %u2013 (47)Tax loss (518) (3,156) %u2013 %u2013 (3,674) (2,519) (3,080) 98 %u2013 (5,501)Deferred tax liabilitiesProperty, plant and equipment/Investment property 1,721 (324) %u2013 %u2013 1,397Intangible assets 668 %u2013 %u2013 %u2013 668Print equipment 6,933 (675) %u2013 %u2013 6,258Employee benefits asset 32,257 1,059 (1,180) %u2013 32,136 41,579 60 (1,180) %u2013 40,459Net deferred tax credit (3,020) (1,082) %u2013