Page 114 - Demo

P. 114

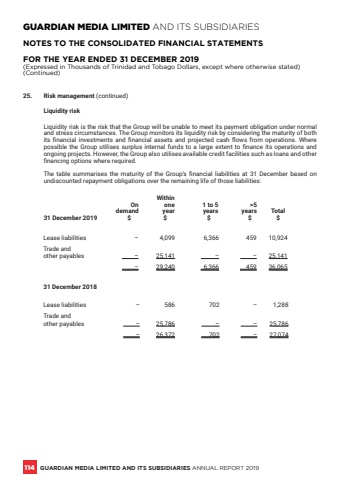

GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2019(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)25. Risk management (continued)Liquidity riskLiquidity risk is the risk that the Group will be unable to meet its payment obligation under normal and stress circumstances. The Group monitors its liquidity risk by considering the maturity of both its financial investments and financial assets and projected cash flows from operations. Where possible the Group utilises surplus internal funds to a large extent to finance its operations and ongoing projects. However, the Group also utilises available credit facilities such as loans and other financing options where required.The table summarises the maturity of the Group%u2019s financial liabilities at 31 December based on undiscounted repayment obligations over the remaining life of those liabilities: WithinOn one 1 to 5 >5demand year years years Total31 December 2019 $ $ $ $ $Lease liabilities %u2013 4,099 6,366 459 10,924Trade andother payables %u2013 25,141 %u2013 %u2013 25,141 %u2013 29,240 6,366 459 36,06531 December 2018Lease liabilities %u2013 586 702 %u2013 1,288Trade andother payables %u2013 25,786 %u2013 %u2013 25,786 %u2013 26,372 702 %u2013 27,074114 GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIES ANNUAL REPORT 2019