Page 105 - Demo

P. 105

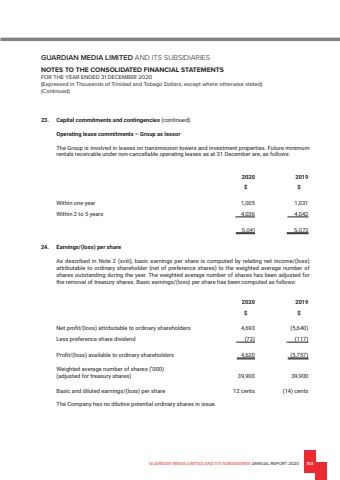

GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIES ANNUAL REPORT 2020 103GUARDIAN MEDIA LIMITED AND ITS SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2020(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)23. Capital commitments and contingencies (continued)Operating lease commitments %u2013 Group as lessorThe Group is involved in leases on transmission towers and investment properties. Future minimum rentals receivable under non-cancellable operating leases as at 31 December are, as follows:24. Earnings/(loss) per shareAs described in Note 2 (xviii), basic earnings per share is computed by relating net income/(loss) attributable to ordinary shareholder (net of preference shares) to the weighted average number of shares outstanding during the year. The weighted average number of shares has been adjusted for the removal of treasury shares. Basic earnings/(loss) per share has been computed as follows:2020 2019$ $Within one year 1,005 1,031Within 2 to 5 years 4,036 4,042 5,041 5,0732020 2019$ $Net profit/(loss) attributable to ordinary shareholders 4,693 (5,640)Less preference share dividend (73) (117)Profit/(loss) available to ordinary shareholders 4,620 (5,757)Weighted average number of shares (%u2019000)(adjusted for treasury shares) 39,900 39,900Basic and diluted earnings/(loss) per share 12 cents (14) centsThe Company has no dilutive potential ordinary shares in issue.