Page 69 - Demo

P. 69

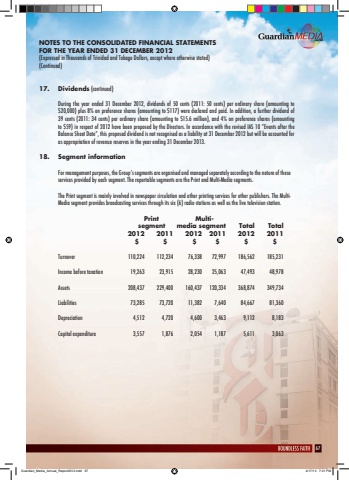

67NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2012(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)17. Dividends (continued)During the year ended 31 December 2012, dividends of 50 cents (2011: 50 cents) per ordinary share (amounting to $20,000) plus 8% on preference shares (amounting to $117) were declared and paid. In addition, a further dividend of 39 cents (2011: 34 cents) per ordinary share (amounting to $15.6 million), and 4% on preference shares (amounting to $59) in respect of 2012 have been proposed by the Directors. In accordance with the revised IAS 10 %u201cEvents after the Balance Sheet Date%u201d, this proposed dividend is not recognised as a liability at 31 December 2012 but will be accounted for as appropriation of revenue reserves in the year ending 31 December 2013.18. Segment informationFor management purposes, the Group%u2019s segments are organised and managed separately according to the nature of these services provided by each segment. The reportable segments are the Print and Multi-Media segments.The Print segment is mainly involved in newspaper circulation and other printing services for other publishers. The MultiMedia segment provides broadcasting services through its six (6) radio stations as well as the live television station.Print Multisegment media segment Total Total2012 2011 2012 2011 2012 2011 $ $ $ $ $ $Turnover 110,224 112,234 76,338 72,997 186,562 185,231Income before taxation 19,263 23,915 28,230 25,063 47,493 48,978Assets 208,437 229,400 160,437 120,334 368,874 349,734Liabilities 73,285 73,720 11,382 7,640 84,667 81,360Depreciation 4,512 4,720 4,600 3,463 9,112 8,183Capital expenditure 3,557 1,876 2,054 1,187 5,611 3,063Guardian_Media_Annual_Report2012.indd 67 4/17/13 7:31 PM