Page 73 - Demo

P. 73

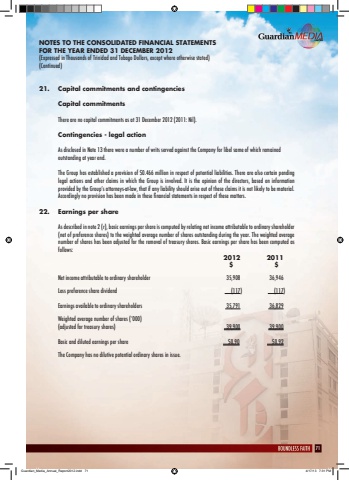

71NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2012(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)21. Capital commitments and contingenciesCapital commitmentsThere are no capital commitments as at 31 December 2012 (2011: Nil).Contingencies - legal actionAs disclosed in Note 13 there were a number of writs served against the Company for libel same of which remained outstanding at year end.The Group has established a provision of $0.466 million in respect of potential liabilities. There are also certain pending legal actions and other claims in which the Group is involved. It is the opinion of the directors, based on information provided by the Group%u2019s attorneys-at-law, that if any liability should arise out of these claims it is not likely to be material. Accordingly no provision has been made in these financial statements in respect of these matters.22. Earnings per shareAs described in note 2 (r), basic earnings per share is computed by relating net income attributable to ordinary shareholder (net of preference shares) to the weighted average number of shares outstanding during the year. The weighted average number of shares has been adjusted for the removal of treasury shares. Basic earnings per share has been computed as follows:2012 2011 $ $Net income attributable to ordinary shareholder 35,908 36,946Less preference share dividend (117) (117)Earnings available to ordinary shareholders 35,791 36,829Weighted average number of shares (%u2018000)(adjusted for treasury shares) 39,900 39,900Basic and diluted earnings per share $0.90 $0.92The Company has no dilutive potential ordinary shares in issue.Guardian_Media_Annual_Report2012.indd 71 4/17/13 7:31 PM