Page 72 - Demo

P. 72

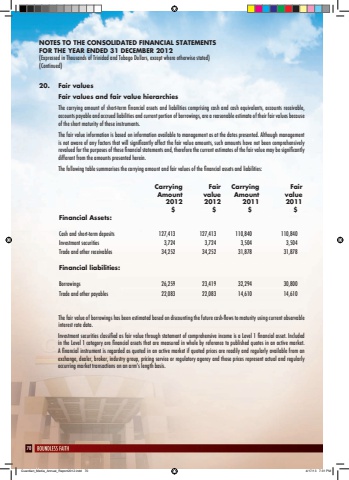

70NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2012(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)20. Fair valuesFair values and fair value hierarchiesThe carrying amount of short-term financial assets and liabilities comprising cash and cash equivalents, accounts receivable, accounts payable and accrued liabilities and current portion of borrowings, are a reasonable estimate of their fair values because of the short maturity of these instruments.The fair value information is based on information available to management as at the dates presented. Although management is not aware of any factors that will significantly affect the fair value amounts, such amounts have not been comprehensively revalued for the purposes of these financial statements and, therefore the current estimates of the fair value may be significantly different from the amounts presented herein.The following table summarises the carrying amount and fair values of the financial assets and liabilities:The fair value of borrowings has been estimated based on discounting the future cash-flows to maturity using current observable interest rate data.Investment securities classified as fair value through statement of comprehensive income is a Level 1 financial asset. Included in the Level 1 category are financial assets that are measured in whole by reference to published quotes in an active market. A financial instrument is regarded as quoted in an active market if quoted prices are readily and regularly available from an exchange, dealer, broker, industry group, pricing service or regulatory agency and those prices represent actual and regularly occurring market transactions on an arm%u2019s length basis.Carrying Fair Carrying FairAmount value Amount value2012 2012 2011 2011$ $ $ $Financial Assets:Cash and short-term deposits 127,413 127,413 110,840 110,840Investment securities 3,724 3,724 3,504 3,504Trade and other receivables 34,252 34,252 31,878 31,878Financial liabilities:Borrowings 26,259 23,419 32,294 30,800Trade and other payables 22,083 22,083 14,610 14,610Guardian_Media_Annual_Report2012.indd 70 4/17/13 7:31 PM