Page 57 - Demo

P. 57

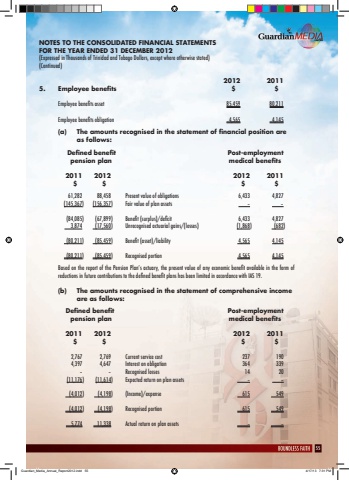

55NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2012(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)2012 20115. Employee benefits $ $Employee benefits asset 85,459 80,211Employee benefits obligation 4,565 4,145(a) The amounts recognised in the statement of financial position are as follows: Defined benefit Post-employment pension plan medical benefits 2011 2012 2012 2011$ $ $ $ 61,282 88,458 Present value of obligations 6,433 4,827(145,367) (156,357) Fair value of plan assets %u2013 %u2013 (84,085) (67,899) Benefit (surplus)/deficit 6,433 4,827 3,874 (17,560) Unrecognised actuarial gains/(losses) (1,868) (682) (80,211) (85,459) Benefit (asset)/liability 4,565 4,145 (80,211) (85,459) Recognised portion 4,565 4,145Based on the report of the Pension Plan%u2019s actuary, the present value of any economic benefit available in the form of reductions in future contributions to the defined benefit plans has been limited in accordance with IAS 19.(b) The amounts recognised in the statement of comprehensive income are as follows: Defined benefit Post-employment pension plan medical benefits 2011 2012 2012 2011$ $ $ $ 2,767 2,769 Current service cost 237 190 4,397 4,647 Interest on obligation 364 339%u2013 %u2013 Recognised losses 14 20(11,176) (11,614) Expected return on plan assets %u2013 %u2013 (4,012) (4,198) (Income)/expense 615 549 (4,012) (4,198) Recognised portion 615 549 5,774 11,338 Actual return on plan assets %u2013 %u2013Guardian_Media_Annual_Report2012.indd 55 4/17/13 7:31 PM