Page 58 - Demo

P. 58

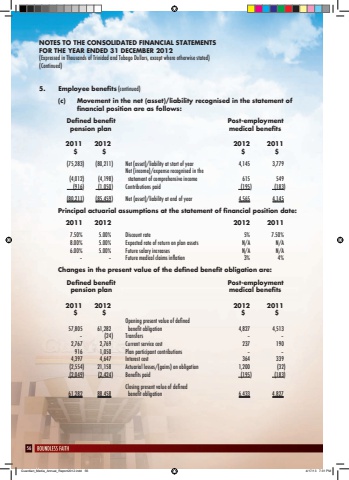

56NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2012(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)5. Employee benefits (continued)(c) Movement in the net (asset)/liability recognised in the statement of financial position are as follows: Defined benefit Post-employment pension plan medical benefits 2011 2012 2012 2011$ $ $ $ (75,283) (80,211) Net (asset)/liability at start of year 4,145 3,779 Net (income)/expense recognised in the (4,012) (4,198) statement of comprehensive income 615 549 (916) (1,050) Contributions paid (195) (183)(80,211) (85,459) Net (asset)/liability at end of year 4,565 4,145 Principal actuarial assumptions at the statement of financial position date: 2011 2012 2012 2011 7.50% 5.00% Discount rate 5% 7.50% 8.00% 5.00% Expected rate of return on plan assets N/A N/A 6.00% 5.00% Future salary increases N/A N/A%u2013 %u2013 Future medical claims inflation 3% 4% Changes in the present value of the defined benefit obligation are: Defined benefit Post-employment pension plan medical benefits 2011 2012 2012 2011$ $ $ $ Opening present value of defined 57,805 61,282 benefit obligation 4,827 4,513%u2013 (24) Transfers %u2013 %u2013 2,767 2,769 Current service cost 237 190916 1,050 Plan participant contributions %u2013 %u20134,397 4,647 Interest cost 364 339 (2,554) 21,158 Actuarial losses/(gains) on obligation 1,200 (32) (2,049) (2,424) Benefits paid (195) (183) Closing present value of defined 61,282 88,458 benefit obligation 6,433 4,827Guardian_Media_Annual_Report2012.indd 56 4/17/13 7:31 PM