Page 59 - Demo

P. 59

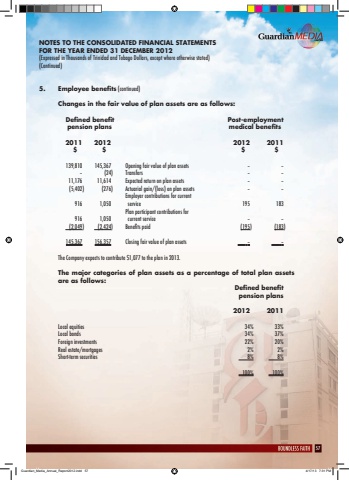

57NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2012(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)5. Employee benefits (continued) Changes in the fair value of plan assets are as follows: Defined benefit Post-employment pension plans medical benefits 2011 2012 2012 2011$ $ $ $ 139,810 145,367 Opening fair value of plan assets %u2013 %u2013%u2013 (24) Transfers %u2013 %u2013 11,176 11,614 Expected return on plan assets %u2013 %u2013 (5,402) (276) Actuarial gain/(loss) on plan assets %u2013 %u2013 Employer contributions for current916 1,050 service 195 183 Plan participant contributions for 916 1,050 current service %u2013 %u2013 (2,049) (2,424) Benefits paid (195) (183)145,367 156,357 Closing fair value of plan assets %u2013 %u2013The Company expects to contribute $1,077 to the plan in 2013.The major categories of plan assets as a percentage of total plan assets are as follows: Defined benefit pension plans 2012 2011Local equities 34% 33%Local bonds 34% 37%Foreign investments 22% 20%Real estate/mortgages 2% 2%Short-term securities 8% 8% 100% 100%Guardian_Media_Annual_Report2012.indd 57 4/17/13 7:31 PM