Page 60 - Demo

P. 60

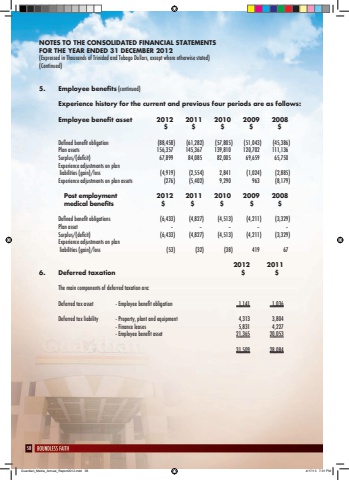

58NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED 31 DECEMBER 2012(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)(Continued)5. Employee benefits (continued)Experience history for the current and previous four periods are as follows:Employee benefit asset 2012 2011 2010 2009 2008$ $ $ $ $Defined benefit obligation (88,458) (61,282) (57,805) (51,043) (45,386)Plan assets 156,357 145,367 139,810 120,702 111,136Surplus/(deficit) 67,899 84,085 82,005 69,659 65,750Experience adjustments on plan liabilities (gain)/loss (4,919) (2,554) 2,841 (1,024) (2,885)Experience adjustments on plan assets (276) (5,402) 9,290 963 (8,179) Post employment 2012 2011 2010 2009 2008 medical benefits $ $ $ $ $Defined benefit obligations (6,433) (4,827) (4,513) (4,211) (3,329)Plan asset %u2013 %u2013 %u2013 %u2013 %u2013Surplus/(deficit) (6,433) (4,827) (4,513) (4,211) (3,329)Experience adjustments on plan liabilities (gain)/loss (53) (32) (38) 419 672012 20116. Deferred taxation $ $The main components of deferred taxation are:Deferred tax asset - Employee benefit obligation 1,141 1,036Deferred tax liability - Property, plant and equipment 4,313 3,804- Finance leases 5,831 4,227- Employee benefit asset 21,365 20,05331,509 28,084Guardian_Media_Annual_Report2012.indd 58 4/17/13 7:31 PM